Expense and rent management is a big deal in shared living, where it may make or break your experience. Keeping in check who owes what may be a major pain in shared living situations, whether with roommates, co-livers, or friends. It’s important to know how to track and manage rent and expense contributions

We’ll look into any problems that could arise when cohabiting and how to effectively resolve them. We can help with everything from dividing the rent and utilities to managing shared costs like food or internet bills. No more unpleasant discussions or late-night calculations to find out who is responsible for whatever is due.

So, if you want to keep the peace in your shared housing situation and prevent financial mistakes, stay put. To make sure that the financial aspects of cohabitation go as smoothly as possible, we’ve got useful advice, tech fixes, and clever strategies. Adopt stress-free shared living and bid financial troubles farewell.

While sharing a place to live or just living with roommates can be a great experience, it’s not always that easy. Keeping track of shared spending is one of the most difficult tasks in these situations, and it calls for attention.

Why is this so important? In a way, people who do cohabiting manage a mini financial ecosystem. Grocery bills, utility bills, rent, and other expenses are always included. Things can go bad fast if these costs aren’t carefully handled. Imagine the frustration of someone who always feels that they’re contributing more than their fair part. Conflicts and bitterness are sure to result from it. Nobody wants to feel as though they are being taken advantage of or labeled as a cheapskate.

Some Steps to Explore about Manage Rent and Expense Contributions

Everyone pays their fair share and believes that they are part of a just and equitable financial arrangement when shared expenses are managed properly. It’s all about fostering an atmosphere of peace, trust, and shared living without worrying about money. In this article, we’ll talk about digital solutions, tips and tricks, and smart strategies to make shared expense management an easier task.

1. Technology

Let’s talk tech first. Financial apps are a great alternative in how to assist you in keeping a precise record of who is owed what, splitting bills, and tracking spending. Eliminate the need for calculators and sticky notes. These apps are handy and they’re here to support you.

2. Creating a Budget

Make a budget that includes all of your shared costs, including rent, utilities, groceries, and everything else, sitting down with your roommates or co-occupants. This budget serves as your financial road map, outlining everyone’s required contributions.

3. Setting Ground Rules

Setting ground rules is like putting glue on everything. Make sure that you have specific policies regarding who pays for what and when. What occurs when a renter is late? How do you deal with unpredicted expenses? You need to establish transparency and trust by putting these guidelines in place.

4. Regular Check-Ins

Effective communication is superior to any advanced technology or budgeting technique. Contacting your roommates regularly helps to maintain peace. It’s an opportunity to discuss money matters, resolve issues, and confirm that everyone agrees with.

5. Emergency Fund

Well, life does have its surprises. It’s important to be always prepared. Having an emergency fund is wise for shared living because of this. Each month, everyone contributes a small amount of money, building a safety net for unforeseen costs. You’re protected in case of the unknown.

6. Be Kind and Fair

The key to shared living is balance. Occasionally, someone may experience a difficult month and be unable to contribute as much. That is normal. Fairness and adaptability then become important factors that need to be taken into account. You need to discover the ideal balance between understanding and fairness. It concerns teamwork after all.

7. Record Keeping

Keeping a record of documents offers accountability and openness. Use a spreadsheet or shared spending ledger to stay organized and know who paid what. There won’t be any misunderstanding since everyone will know about it!

8. Review and Revise!

Life progresses and things change. One may move out, or the rent may increase. So it’s important to review and change your spending control strategies. Make sure that your ground rules and budget are flexible to your changing circumstances.

In addition to financial advantages, shared living fosters a sense of community and trust. With technology, planning, ground rules, and honest communication, you may have the benefits of shared living without the hassles of money. Try these ideas and keep the positive energy flowing; they will help you navigate the shared living experience with ease.

Frequently Asked Questions about Manage Rent and Expense Contributions

Here are some questions that will help us understand even more on how to track and manage rent and expense contributions when it comes to co-living for any person considering it and just curious about the topic. The answers to these questions are helpful as they dig into another level of the main subject of our blog.

Q: How can technology assist in managing rent and expense contributions?

Your greatest ally for the organization is technology. Check them out and see which one would benefit you in the long run. These programs assist you in keeping a precise record of who owes what, splitting bills, and tracking spending. Eliminate headaches caused by sticky notes or laborious calculations. In addition to saving time, these technological solutions guarantee that everyone fulfills their financial obligations on time.

Q: What challenges might individuals face when tracking and managing shared expenses?

Occasionally, overseeing shared spending may look like a pain. Making sure that no one is falling behind on rent and holding each other accountable is a regular challenge as well. Another common cause of misunderstandings is forgetting who covered what. Open communication and simple ground rules are essential because of this.

Q: How can conflicts regarding shared expenses be avoided or resolved?

The best protection against conflict is to lay down ground rules in advance. Everyone needs to be aware of their responsibilities as well as what occurs when someone lags. Frequent check-ins are also necessary to identify problems early and resolve them in a friendly manner. When disagreements happen, it’s important to stay calm and not tense, pay attention to one another’s worries, and work together to find solutions.

Q: Are there any legal considerations when managing shared living expenses?

It depends on where you live in general. Legally speaking, your lease or rental agreement should control your shared living expenses. It’s important to comprehend the conditions of your lease and how co-occupants or roommates split costs. It is always a good idea to speak with a legal professional or get guidance from a local tenant’s group if you have specific legal questions or concerns. On the legal side of shared spending, it’s best to be safer than sorry.

An Example For All

The article, “Co-living apartments offer a sense of community for on-the-go millennials”, by The Sunday Magazine on CBC Radio, introduces us to Khatija Ali. A 28-year-old graduate from Toronto who moved to New York. Looking for a place to stay, she was amazed by a two-bedroom furnished apartment that involved co-living. Ali’s apartment had 14 people living in it. She explained that they’re all from diverse backgrounds which seemed appealing for the social aspect. Her rent was around what would be considered normal for a normal apartment in Bushwick. However, all the benefits from co-living made it an attractive place to live in such as free Wi-fi, lounges, gyms and hot tubs, housekeeping, and more. All these costs are shared by the members living in Ali’s building. The article explains the benefits of such practice in our society and its conditions. If managed well, everyone would be happy like Khatija Ali.

These case studies show how the suggested strategies are being used by people. Using technology, setting up a budget, keeping lines of communication open, or using a mix of these strategies can make cohabitation easy. In summary, learn from them and create a peaceful living environment for the two of you.

Keeping track of spending and rent contributions may not seem rich in the world of cohabitation, but it’s the key to a peaceful cohabitation experience. The tactics we’ve looked at—from budgeting and open communication to technological apps—go beyond simple calculations. Their goal is to establish an environment that fosters fairness, trust, and community.

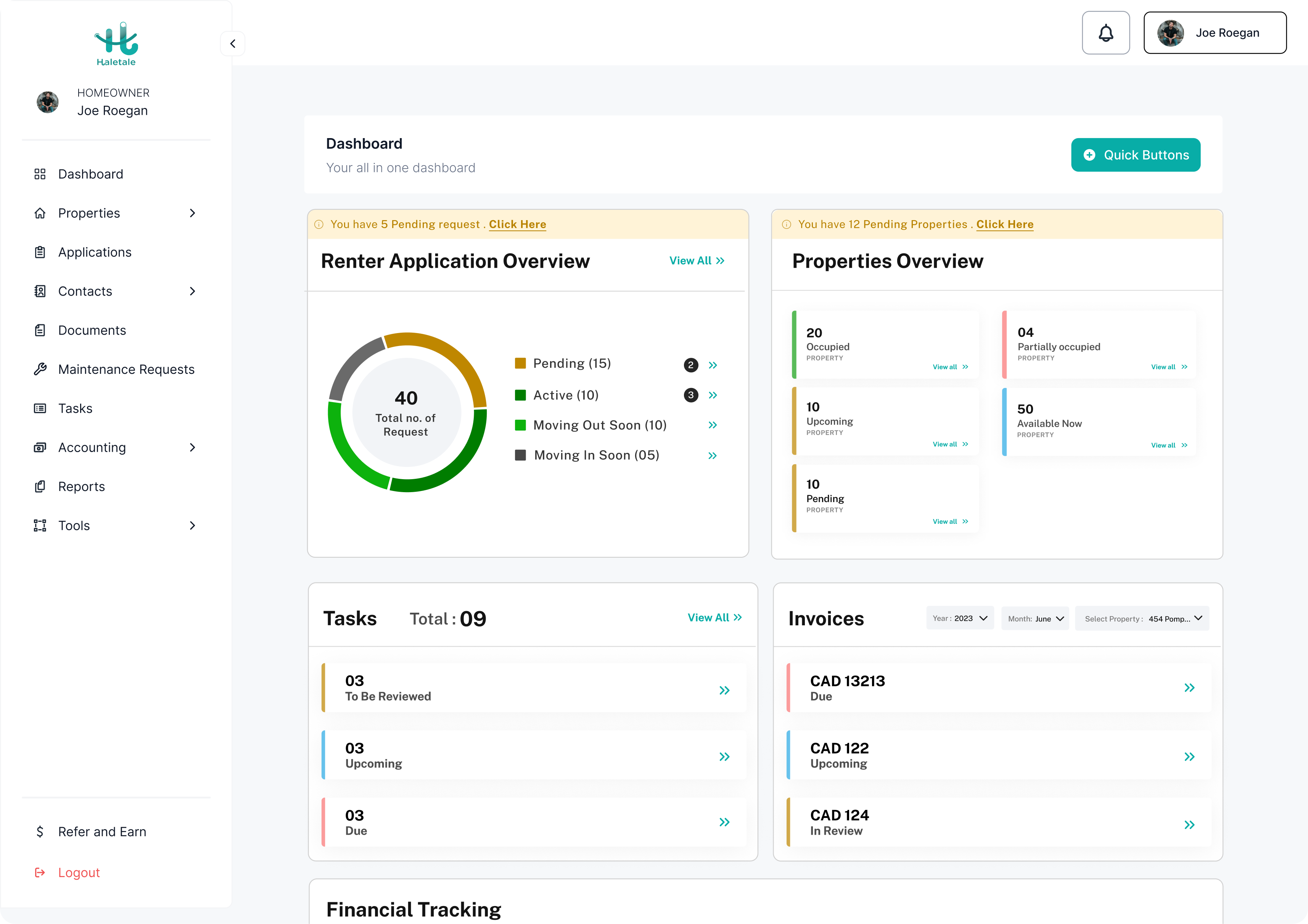

Smarter Property Management

Find the best Rental Property Management Software in Canada. Transform your Rental property into a cash-generating asset with our user-friendly property management software solution.

Conclusion

So, these tips can make the sometimes difficult task of splitting household bills seem easy for anyone sharing a living space, be it a young professional, college student, or anybody else. Accept them, and you will have a joyful co-living experience. And do share this article with others if you found it useful! Give it to your roommates, co-living friends, or anybody else you know who could use some advice on how to make splitting costs easy. Spreading knowledge is always welcomed!

Source:

https://www.cbc.ca/radio/sunday/the-sunday-edition-for-june-9-2019-1.5165327/co-living-apartments-offer-a-sense-of-community-for-on-the-go-millennials-1.5165343

Related Articles

7 Common Mistakes in Selecting a Coliving Space

Finding Your Perfect Shared Living Space in Canada

Property Management Income and Expenses for Beginners 101