A financial balancing act is similar to property management Income and Expenses. One source of income for you is the money you receive from fees and rent, for example. In addition, there are costs, which include items such as upkeep, taxes, invoices, and insurance. The manner in which you handle this delicate balancing act can have a big impact on the result of your real estate project. It affects your investment’s way of making profits, stability, and in general its performance. In this blog, we will explore into the details of property management income and costs. Advice and ideas will be shown to help managers and owners of real estate properties to stay on track with their real estate ideas and improve their financial plans.

So, What Really is Property Management Income?

Property owners and managers depend on property management income as their major source of income when they start getting into the real estate investing market. This income is a combination of all the money that is received from renting out real estate, which is mostly through tenant rent payments. Although, it includes additional income from services offered to any renters: parking, laundry, late fees, and other items, as well as rent. Also, income from property management can be the base for both financial security and real estate success. It’s important for the financial stability of property owners since it allows them to handle necessary expenses: such as property taxes, mortgage payments, and maintenance costs. Also, this is not only about stability; it’s also about the need for an increase in real estate investment returns, asset growth, and sustainability. This type of income allows property owners to improve their properties, attract high-paying tenants, and increase the value of their real estate investments.

Should We Aim in Maximizing Property Income?

-

Market Analysis:

The first step is to research the market which means finding out about the rental rates in your area and comparing them with your current prices.

-

Regular Rent Reviews:

Keep those rent reviews in your mind and don’t get too comfy with your current rental pricing. Keep checking on them especially when the lease is close for renewal.

-

Upgrade and Renovate:

Think about giving your property an upgrades or renovation can make your place look much better and could be a support for charging a higher rent.

-

Add Amenities:

You might want to think about adding things: in-unit laundry, a fitness center, or covered parking, and more.

-

Tenant Retention:

Tenant happiness is an important factor. Keep your tenants happy, be quick with maintenance, and think about ways for tenants to

-

Short-Term Rentals:

Depending on your location, you might want to explore short-term rentals through other ways like Airbnb. But make sure to check your local laws before attempting this idea.

-

Pet-Friendly Policies:

Many tenants have pets, and being pet-friendly can attract a lot of tenants willing to pay more for pet-friendly accommodations.

-

Utilities and Fees:

Consider doing an upgrade to your utility payment plan. Think about including some in the rent or charging extra for certain things.

-

Good Marketing Skills:

When it comes to boosting rental income, go all out for your property marketing. Use good quality photos, and detailed descriptions of the home, and explore online rental platforms to reach a broader audience.

-

Long-Term Leases:

Offering longer lease terms is a smart move.

-

Property Management:

Consider taking advice from professionals. Hiring a professional property management company can be an advantage for different services: marketing, tenant screening, maintenance, and rent collection.

-

Tax Strategies:

Get some advice from an actual expert. Try to explore any possible tax strategies that can boost your rental.

Put Your hands in the Mastering Property Management Income Game

Property management expenses involve a variety of costs-related elements of owning and running a real estate asset. They can be divided into different categories: maintenance and repairs, utilities, property taxes, insurance, management fees, marketing and advertising expenses, legal and administrative fees, and vacancy costs. Each of these areas are important when it comes to maximizing property income, from keeping the property in good shape to attracting and retaining tenants. Property taxes fund public services, while insurance provides a safety net against unexpected disasters. Property management companies get their cut through management fees, and marketing costs are like a magnet that attracts future tenants. Legal and administrative fees make sure all the rules are maintained and respected, and vacancy expenses are a safety net for those periods when the rent isn’t coming. It’s important to manage these costs in a smart way because they have an influence on the property’s long such as long-term health, financial stability, and tenant satisfaction.

A Little List for Managing Property Expenses

-

Proactive Maintenance:

Do some regular maintenance on the property so that things stay stable.

-

Energy Efficiency Upgrades:

Think about installing energy-efficient HVAC systems, lighting, and any appliances seen as “green” for the environment.

-

Vendor and Supplier Negotiations:

Build good relationships with your suppliers. Negotiate for a good pricing and explore bulk purchase discounts if offered.

-

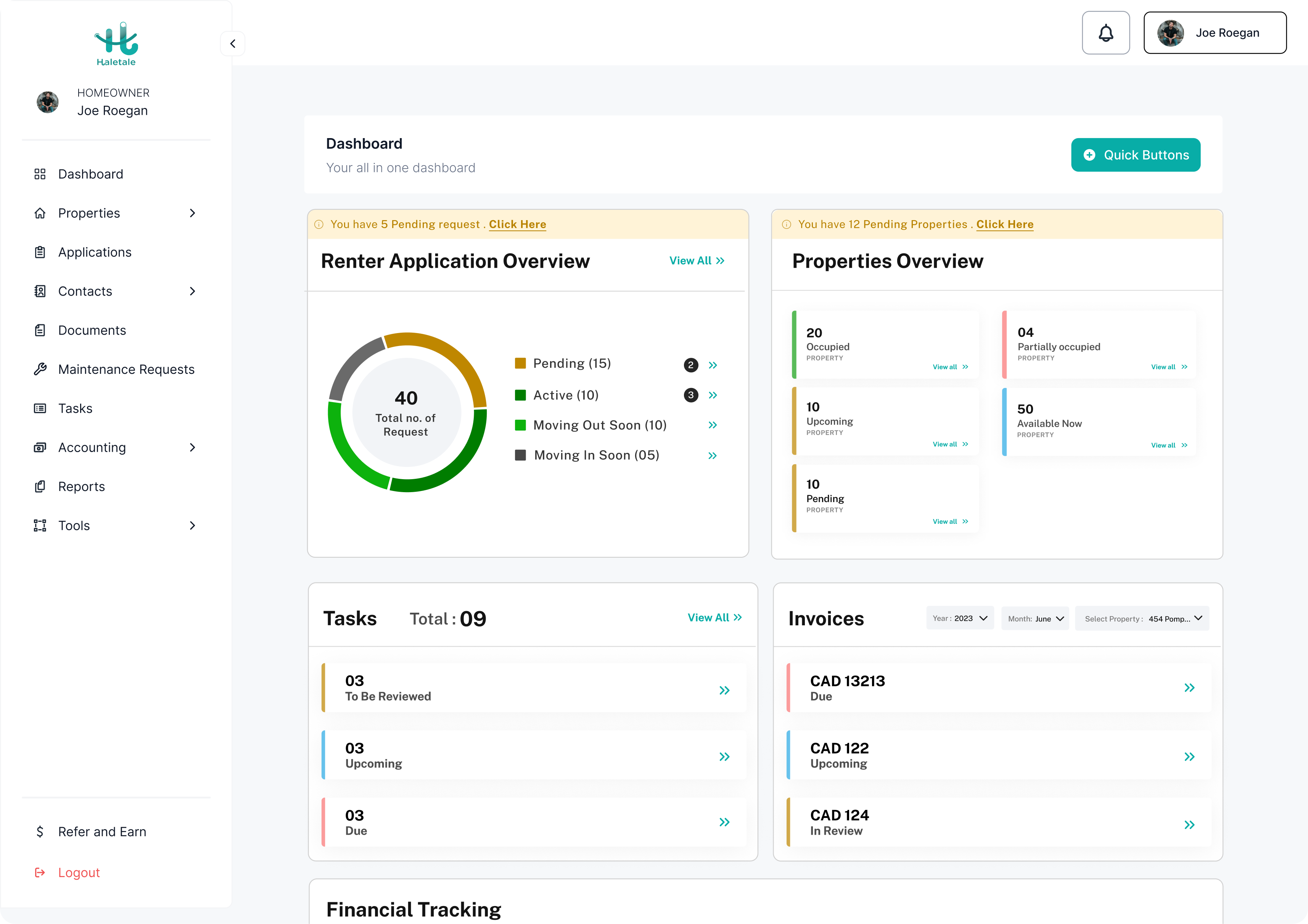

Technology :

A property management software is a great tool that can keep track of your operations and cut administrative costs by automating tasks like rent collection, lease management, and financial reporting.

-

Tenant Screening and Retention:

Examine potential tenants carefully to avoid the risk of rent defaults or property damage. Having good relations can lead to better profits and references between tenants.

-

Insurance Review:

Review from time to time your property insurance to make sure it’s updated and cost-effective. Think about bundle insurance plans or raised deductibles to reduce premiums.

-

Budgeting and Financial Planning:

Create a detailed budget that includes all expected expenses and adjust it depending on circumstances. Think about doing an emergency fund to handle unexpected expenses that may arise in the future.

-

Tax Deductions:

Try to educate yourself about available tax deductions for property owners, such as mortgage interest, property taxes, and depreciation.

-

Outsourcing Property Management:

Think about hiring a professional property management company. While there are management fees, there are many benefits associated with it. Property managers have the expertise to reduce expenses and maximize income.

-

-

Water and Resource Conservation:

-

Stay green! Get some water-saving technology, such as low-flow faucets and toilets, to cut down on water bills. Think about some landscaping ideas that need less water and maintenance.

-

-

Regular Reconciliation:

-

Link your financial records with bank statements to catch errors and secure accuracy. Accounting mistakes can lead to extra expenses which you totally want to avoid.

-

-

Tenant and Lease Management Software:

-

Use software solutions to manage tenant information, lease agreements, and rent collection.

Is Property Management Budgeting Really that Important?

In studying property management costs, we are digging into the monetary obligations associated with property ownership and management. These costs have an important effect on the property’s survival and financial stability, which makes them an essential element to property management. The first is maintenance and repair costs. They’re focused in making sure the property is in peak condition to avoid future issues that could cause even bigger problems. Another cost that owners of real estate encounter is property taxe that are collected by the government. Utility bills are another factor as they are things that a person can’t live without: gas, water, and electricity. To prevent unexpected events and potential losses, property insurance is important. Let’s not forget that this money is given to property management companies as a form of management fees. They handle a range of property management jobs, including maintenance, cleaning, and tenant relations. To attract in tenants, you must spend money on advertisement and marketing. Legal and administrative fees guarantee that you stay within the regulations, and there are, of course, charges related to empty periods when the property isn’t renting. Consider your mortgage payments in the absence of rental revenue. The fact that these expenses can make or break a property’s financial stability makes it obvious that understanding them is very important. Owners and managers who successfully handle these expenses can secure earnings, maintain the property’s quality, and satisfy everyone.

Don’t Forget about Tax Considerations!

Understanding taxes in property management is an advantage like no other in your financial goals. Income tax is the real aim when it concerns rental income, and you’ve got to put the exact details on your tax returns. Managing your money properly will benefit you in the long run because the good news is that you can often offset your taxable income with costs and deductions. Extra income needs to be noted on your mind because they’re taxable too: parking fines, laundry moolah, and even late rent.

In addition, speaking of deductions, make sure to keep records or traces of all those property repairs because they’re usually a source of deduction. But dont forget that there can always be exceptions to the rule. As an example, if you are upgrading your property with some new features or renovations, they might not be deductible. So always make sure what you plan for your property.

If your property is on the mortgage bandwagon, pay attention to the fact that the interest you’re paying can be deducted from your income, depending on the context.

Finally, depreciation is where the property tax can give you a great advantage. The cost of your property can be put out over time. In addition, capital improvements on the property resulting in longer leases can offer a depreciation in the value as well.

Some Tips for Maintaining Financial Performance

- Property Management Software: They help you keep track of rent payments, and expenses, and can offer financial reports that will be super helpful as a property owner.

- Budgets and Financial Reports: Create budgets that plan any expected income and expenses.. That’s the key to your treasure vault. Make sure to keep a regular check and compare it with past records in order to see if you’re maintaining a good track record.

- Online Banking and Accounting Software:, Online banking is a great asset to have as it keeps track of every detail such as: managing expenses, tracking income, and writing up financial reports.

- Receipt and Document Management: Using digital platforms is much easier and more handy in this time and age.

- Mobile Applications:. The mobile version of property management and accounting applications is super helpful for an owner. You get every detail with just a swipe!

- Expense Tracking Tools: Think of these tools as a way to keep records of your expenses.

- Regular Reconciliation: This prevents from any errors happening.

- Tenant and Lease Management Software: It’s very helpful for managing: tenants, leases, and collecting rent.

- Key Performance Indicators (KPIs):Decide which KPIs are unique to your property and monitor them, such as occupancy rates, rental yield, and the net of wealth you’re gathering (net operational income).

Let’s View Some Property Management Financial Tips

- Budget Carefully: Having a clear budget sets a clear plan on the expectations for spending and earning money.

- Tenant Loyalty: Make sure to keep your tenants happy, as they might want to do longer leases.

- Emergency Fund: Having extra money aside is always safer than nothing.

- Manage Expenses: Check your spending and don’t let it make you overlook your property.

- Regular Maintenance: Preventative maintenance can save you money by preventing more significant future expenses.

- Rent Collection: Adopt a rent collection method that guarantees on-time payments and reduces late fees from tenants

- Tax Planning: Understand the tax implications of property management and get some professional advice on getting deductions.

- Insurance Coverage: Maintain the right insurance that covers your property and liability, to protect your investment.

- Vendor Relationships: Having a good relationship with suppliers and vendors to get better pricing and terms, which is a great plus!

- Financial Reports: Always make sure review financial reports to gain ideas into your property’s financial health. Turn your reviews into a routine.

Frequently Asked Questions

Q: What is property management income, and why is it important for property owners and managers?

A: Property management income is money generated by managing real estate properties. This includes rent, leasing fees, and ancillary income. For owners, this signifies return on investment. As for managers, it means money for their services. It guarantees cash flow, property value and profitability.

Q: What are the common sources of property income?

A: The money paid by renters, leasing fees from signing and renewing leases, and ancillary income from extra services and amenities from the properties are common sources.

Q: How can property managers maximize rental income?

A: Property managers can maximize rental income by conducting market research as a way to have: competitive rents, enhancing property appeal, employing effective marketing strategies, and offering excellent tenant services to reduce vacancies. .

Q: What are property management expenses, and what are typical costs associated with them?

A: Property management expenses are costs associated happened in maintaining properties. The following are elements considered as typical expenses maintenance, property taxes, insurance, management fees, utilities, and marketing/advertising costs.

Q: How can property managers reduce expenses and improve profitability?

A: Strategies include regular maintenance, trying to get better deal with negotiation, integrating energy-efficient measures and automated administrative functions.

Q: What is property management budgeting, and why is it essential?

A: Property management budgeting focuses on predicting income, and costs, having financial goals, and checking progress. It’s important as it is a necessity for planning, allocating resources, and ensuring financial stability in property management.

Q: Are there tax implications for property management income and expenses?

A: Yes, there are! Which is why consulting an expert in the field might prove to be super helpful in the long run.

Q: How can property owners track their financial performance effectively?

A: Property owners can use accounting software or property management software to manage their progress in real-time. In addition, they can also create spreadsheets to track income and expenses accurately.

Q: What are some financial tips for successful property management?

A: In general, aim for these four things:

- Always review and adjust rental rates.

- Try to get tenants to stay longer.

- Keep excellent records of everything.

- Try to install things in your property that are good for the long run and won’t give you unexpected costs.

Smarter Property Management

Find the best Rental Property Management Software in Canada. Transform your Rental property into a cash-generating asset with our user-friendly property management software solution.

Conclusion

To summarize, the key to successful property management is finding a balance between income and expenses. It’s important that you manage your rental revenue, maintain a consistent source of income from various sources, and ensure your tenants are happy. Don’t forget about those costs, though. Just as essential are managing expenses, maintaining your home, and being ready for emergencies. Understanding these financial issues and using certain smart methods is necessary whether your goal is to build a profitable real estate portfolio, protect your financial future, or simply maintain the condition of your investments.

There is lots of information available, so don’t be shy to ask questions, get in touch with the experts, and receive the advice you need to manage your property management budget successfully. All it takes to succeed in property management is a smart financial move!

Related Articles

How to Prepare for a Rental Inspection

Tips For Efficient Tenant Management

Quick Guide on Tenant’s Rights & Responsibilities