The field of real estate is undergoing a very significant change led by the application of AI technology which is advancing at a very fast pace. AI has been instrumental in changing the way investors are handling real estate, through data-driven decision making, predictive analytics, and speedy processes. As the importance of AI keeps increasing, it is remaking the real estate market worldwide, granting investors tools and insights they had never conceived before. Here is all about How AI Can Help in Real Estate Investing.

This transforming effect is demonstrated in quite a few sectors of the industry, be it property value assessment and market analysis or risk assessment and portfolio optimization. Artificial intelligence (AI) systems are capable of processing massive amounts of data, discovering patterns, and presenting information that investors need to take informed decisions, reduce risks and catch new openings. This, in turn, is making AI an irreplaceable tool for property investors who are always anxious about gaining an edge over their competitors in a rapidly changing economic environment.

Understanding AI in Real Estate

AI is now the dominating force in shaping the real estate investment environment. AI employs sophisticated algorithms and machine learning models to analyze vast amounts of data, discover trends and offer insights which are instrumental for the investors in making the right choices.

- Property Valuation and Price Prediction: AI algorithms can evaluate properties with accuracy by considering many data points, including the location, market trends, historical sales data, and structure features of the property. This increases the precision and feasibility of valuations and pricing strategies.

- Investment Analysis and Opportunity Identification: AI-powered systems take into account the location, market dynamics, expected returns, and risks to pick very profitable investment opportunities. Through this, investors are provided with an opportunity to optimize their portfolios and thus get best returns for their investments.

- Predictive Analytics and Forecasting: AI may use machine learning models and historical data to forecast market trends, tenants’ preferences and economic indicators. With such this predictiveness, investors can foresee the market movements and make their strategic decisions prior.

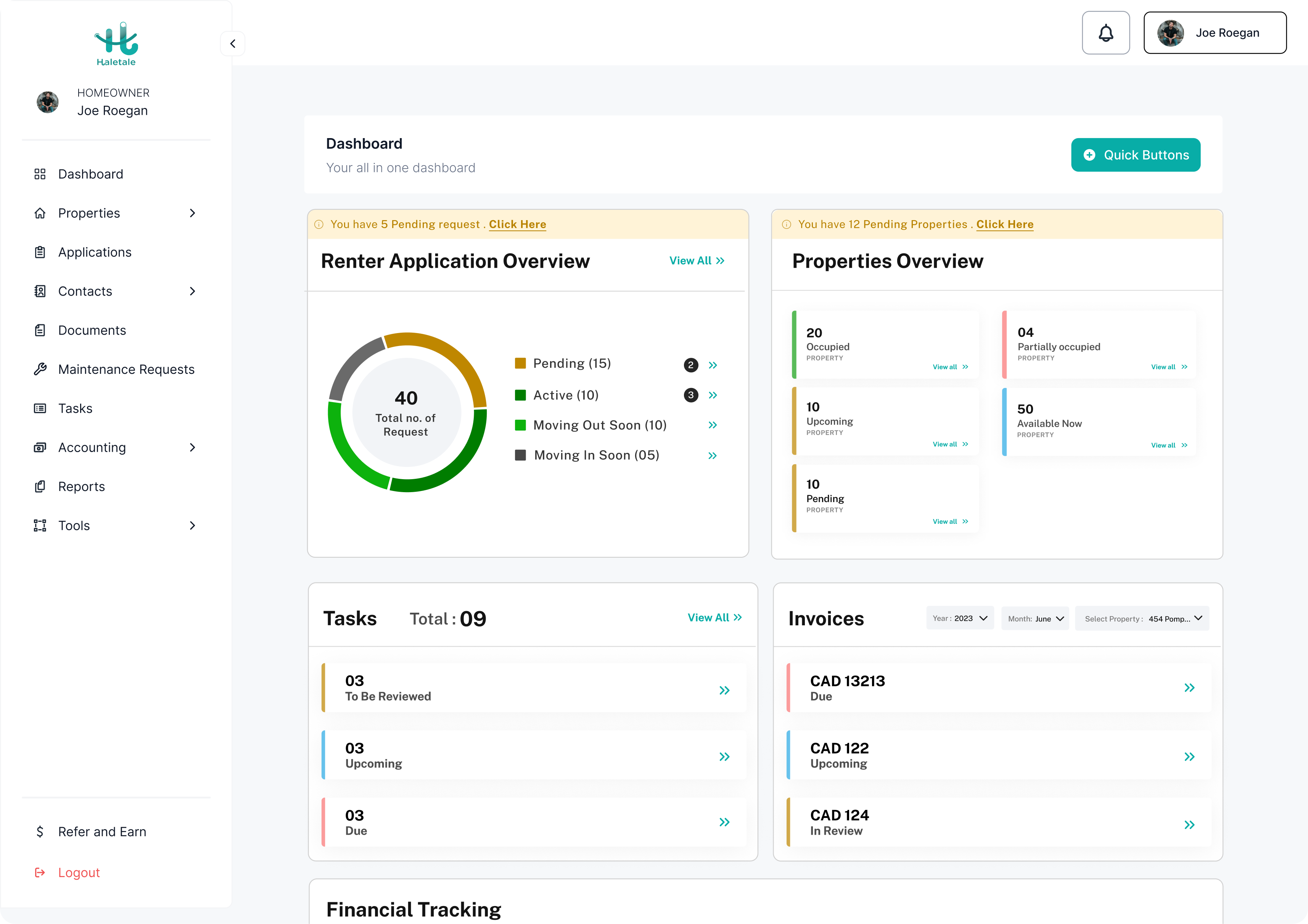

- Automation and Process Optimization: AI has the power to automate many different tasks, including property management, tenant screening, rent collection, and maintenance requests. This automation increases operational efficiency and lowers the costs.

- Data-driven Decision Making: AI´s capability to analyze and process massive amounts of data gives investors access to data-driven insights, minimizing bias and enabling more accurate and informed decisions.

AI’s role in real estate investing is primarily to offer investors an edge to stay ahead of the competition, to mitigate risks, and to uncover opportunities for profit and growth.

Applications of AI in Real Estate Investing

Market Analysis and Forecasting

Algorithms are capable of processing large amounts of data and therefore giving the investment community the ability to get a grasp of the market dynamics and trends. Analyzing historical data, economic indicators, demographic patterns, and consumer behavior provides AI the capability to create accurate forecasts and identify new market opportunities.

- Property Valuation and Price Prediction: AI models can make highly accurate home valuation decisions by taking into account factors like location, property stuff, market statistics, and past housing sales. Value judgment precision is improved, so that it’s easier for the investors to make the buy or sell decisions about real estate objects.

- Market Trend Analysis: AI can manage supply and demand dynamics, vacancy rates, economic indicators, and market factors direction to discover hidden talents that the human analysts do not see. This in turn gives investors a great tool that allows them to accurately predict market shifts and act on it in real time.

Risk Assessment and Management

AI is integrated into property risk identification and management. Through the investigation of various risk factors AI helps investors to make data-oriented solutions that allow them to track movements of the market and develop risk management strategies.

- Location and Demographic Analysis: AI algorithms can even consider location-specific factors e. g. neighboring facilities, transport system, and development plans influence property prices and investment returns. Furthermore, AI can identify demographic data to sense tenants’ demands and market inclinations which enables the investors to recalibrate their strategies accordingly.

- Economic and Regulatory Risk Assessment: AI can keep track of and analyze economic indicators, rule-making changes, and geopolitical factors which may affect real estate markets. Investors can thus undertake due diligence and make prompt decisions to re-arrange their investment portfolios or review their strategies.

- Natural Disaster and Environmental Risk Evaluation: AI can scrutinize historical data, predictive models, and natural disaster, climate change, and environmental impact predictions on real estate investments. This data enables investors to knowledge-based risk-mitigation and make well informed decisions regarding property acquisitions or divestments.

Portfolio Optimization

AI can assume a key position in the adjustment of the real estate investment portfolios to the current conditions, monitoring of different factors and offering data-based conclusions of maximizing the return with minimum risk.

- Investment Opportunity Identification: AI algorithms can examine information related to market, property, and investment criteria to find the most profitable chances that fit their investor’s goals and risk tolerance. As a result, investors can benefit from portfolio diversification and take advantage of new opportunities.

- Automated Property Management: AI is capable of simplifying many property management tasks, including tenant screening, rent collection and maintenance scheduling, decreasing expenses and increasing operational efficiency as a result. Such automation provides an opportunity for investors to concentrate on strategic decision making, as well as portfolio optimization.

Through the utilization of the AI technology across the real estate applications, investors can make their competitive edge more powerful, their risks minimized, and the new opportunities for growth unveiled in a highly dynamic and changing market .

FAQs:

Q: How is AI transforming real estate investing?

- Enhanced Property Valuation and Market Analysis: The AI-powered algorithms can process big data in real time with a higher accuracy and provide investors with the most comprehensive look at the market, letting investors make informed decisions.

- Predictive Analytics for Investment Strategies: AI is capable of analyzing data patterns, emerging markets and historical performance to forecast future market developments and property appreciation rates, which enables investors to make better investment decisions and to re-tune their investment portfolios.

- Smart Property Management: AI-driven systems allow employees to monitor properties in real-time, identify maintenance problems, and deal with tenant issues, which result in increased productivity, safety, and tenant satisfaction.

Q: What are the benefits of using AI in real estate market analysis?

A: Explore how AI aids in accurate market predictions and investment decisions.

- Enhanced Property Valuation

AI-powered algorithms may be able to process and analyze vast volumes of data: such as property attributes, sales history and market trends that can help to offer more precise and impartial valuations. This increases the transparency in the business, reduces the chances of bias and facilitates better pricing and sales decisions.

- Predictive Analytics for Investment Decisions

AI is capable of analyzing economic variables, demographics, and housing market patterns to predict real estate appreciation, identify investment opportunities, and evaluate risks. These insights help real estate investors make better-informed decisions, optimize their portfolios, and maximize returns.

- Improved Market Insights and Forecasting

AI algorithms can process and analyze enormous data about the real estate market and give us an idea about the market trends, pricing strategy and shift in demand-supply dynamics. It assists real estate professionals to make informed decisions, e. g. insights on target markets and pricing strategies and investment opportunities.

Q: How does AI assist in risk management for real estate investments?

A: Examine the role of AI in identifying and mitigating investment risks.

- Identifying Potential Risks

AI-driven analysis has the ability to spot overlooked elements that are critical to the property like environmental risks or legal complexities. With this early warning system, investors have the opportunity to introduce prevention measures in order to avoid financial loss.

- Customized Risk Management Strategies

Investors have different risk characteristics, ways of approaching the market and financial objectives. AI can enable the creation of specific risk management techniques that simultaneously meet an investor’s requirements and tolerability of risk. The bond portfolio of conservative investors seeking to preserve wealth can be strategically optimized for lower risks, while that of aggressive investors seeking better performance can be designed to maximize upside potential.

- Proactive Risk Mitigation

Timely risk management is very important for bettering an investment portfolio and reducing losses. AI-powered risk management technologies enable predicting and resolving of problems at earlier stages which allow for better portfolio performance, higher returns, and lower risks.

Find the best Rental Property Management Software in Canada. Transform your Rental property into a cash-generating asset with our user-friendly property management software solution.

Smarter Property Management

Conclusion

The integration of AI into real estate investing has been transformative, empowering investors to make more informed decisions, streamline processes, and potentially achieve higher returns. By leveraging AI-powered technologies, real estate professionals can benefit from enhanced property valuations, predictive analytics for investment strategies, personalized recommendations, and improved risk management. These advancements have the potential to revolutionize the industry, driving greater efficiency, accuracy, and profitability in real estate investing.

Call to Action

As the real estate industry continues to evolve, it is crucial for investors to explore and implement AI-driven strategies to stay ahead of the curve. By embracing the power of AI, you can gain a competitive edge, make more informed investment decisions, and unlock new opportunities for growth and success. We encourage you to explore the various AI technologies available and consider how they can be integrated into your real estate investment approach. If you have any questions or would like to learn more, please don’t hesitate to reach out to us. We are here to guide you through the transformative world of AI-powered real estate investing.