Landlords’ reporting of rent has been more common in the real estate market in recent years. Because it can affect people’s credit ratings and general financial well-being, the practice of landlords reporting their tenants’ rental payment history to credit bureaus has become increasingly popular. Tenants and property owners alike should now be more aware of the possible advantages and ramifications of rent reporting as more landlords choose this strategy. Here is all about how landlords can report rent for tenants.

This pattern is a reflection of how credit scoring is changing and how important it is to consider rental payments when evaluating a person’s creditworthiness. Landlords and lenders can obtain a more thorough picture of an individual’s financial responsibilities by including rental history into credit reports, which may lead to new chances for those with little to no credit history.

Understanding Rent Reporting

Rent reporting is the process by which your landlord or property manager can report to credit bureaus, such as TransUnion, Equifax, and Experian, about how much you have paid per month on your past and sometimes recent rent. If you pay your rent on time on a regular basis, it can help improve or build your credit history, which impacts whether your credit score goes up or down.

How does that work? Typically, a for-profit rent reporting service has access to your rental payment information and sends it the credit agencies, with permission from your landlord or property management business, enabling the recording of this information to your credit records if paid on time; those with paid-in-full rental payments will show this history to their future landlords or any future business inquiries about their credit score. Rent reporting service is important since it benefits landlords as well.

For tenants, it gives them a path to build a credit score without incurring any additional debt, as rent is often a tenant’s largest expenditure each month. Having their payments report can also give tenants access to lower interest rates on loans and credit cards.

Rent reporting can act as a differentiator for landlords, especially by bringing in tenants who are more inclined to pay responsibly, helping to commercialize the rent payment from a legal perspective and help see more timely payments. As a result, landlords can reap the benefits of a more consistent cash flow and participate in a healthier relationship with their tenants. Furthermore, it can help attract more tenants on both sides, and can bring about a brighter future for both parties. However, these peer-to-peer equity developers need to make sure they comply with specific rules about credit reporting, and understand principals, like the Fair Credit Reporting Act in the United States, which were created to protect consumers. In the end, rent reporting can become an equity multiplier, ensuring that landlords have strong tenants while tenants have loving landlords, ensuring a robust relationship where both sides benefit.

Benefits of Rent Reporting for Tenants and Landlords

Improved Credit Scores for Tenants

For renters, one of the biggest advantages of rent reporting is the credit-score boost. When landlords report on-time rent payments to the credit bureaus, those good payment histories become part of a renter’s credit report. In some cases, this can result in an increase of 60 points to a renter’s credit score over 24 months. A higher credit score means a renter might qualify for a lower interest rate on an auto loan, credit card, or even mortgage. And if a landlord does a credit check, a higher score can help a renter secure a future agreement, since many landlords use credit scores as a factor in the tenant-screening process.

Strengthening Tenant-Landlord Relationships

Rent reporting is also a very important agent in fostering transparency between landlords and the tenants.

Through flagging tenants with timely as well as those who are late/missing on the payments the landlords can easily identify responsible tenants and can save them from the risk of delinquent accounts. This data could be the differentiating factor that puts tenants on an equal playing field in the rental application process, for the reason that it proves financial good standing and dependability.

For property owners, Rent Reporting Services such as the Landlord Credit Bureau (LCB) offer a possibility to optimize the management of their properties, leaseholders’ profiles and payments process more rationally.

Landlords can run credit checks on a potential tenant and go through their rent payment history, which assists the landlords to make justified decisions, preventing any potential losses that landlords may suffer in the future.This, after all, benefits responsible tenants who raise their chances of becoming the preferred renters in a number of nice properties.

FAQs:

Q: Why should landlords consider reporting rent for tenants?

Landlords can consider reporting rent for their tenants for the following reasons:

- Improved tenant credit scores: This is particularly beneficial for those with limited or no credit history, because by reporting on-time rental payments, landlords can help improve tenant credit scores.

- Attracting reliable tenants: Landlords that report rent payments may attract tenants who are keen on building their credit, potentially leading to a more financially responsible tenant base

Q: How does rent reporting affect a tenant’s credit score?

A: Improved credit scores:

Reporting on-time rent payments to credit bureaus such as equifax can help tenants build or improve their credit scores. This is particularly beneficial for those with little to no credit history, as rent payments can become a form of credit-building without taking on debt.

Potential credit score damage: Late or missed rent payments, if reported to credit bureaus, can negatively impact a tenant’s credit score.

Q: What are the challenges landlords face in reporting rent?

A: Increased Administrative Burden:

Landlords may have to do additional work in order to accurately track and report rent payments to credit bureaus. This can be time-consuming

Q: Are there any legal considerations in rent reporting?

A: The legal requirements for rent reporting can vary slightly between provinces. Landlords should familiarize themselves with the specific laws and regulations in their jurisdiction

Conclusion

Rent reporting can be a dual benefit for landlords and tenants provided that proper implementation practices are in place that are within the confines of the law and administration guideline. To help the tenants build credit or to improve credit scores, the landlords may report on-time rent payments to the credit bureaus. This financially responsible behavior may be incentivized to attract a dependable group of tenants. For tenants of the credit building programme, this will create good credit histories, improved opportunities for future accommodations, and having the capability to prove their financial responsibility. It is therefore vital for the landlords to handle the administrative, cost and legal aspects of the rent reporting process effectively so that the whole process may run smoothly and be transparent. All in all, the inclusion of rent payments into the credit scoring can prove to be a clever instrument for landlords and the tenants if the required precautions and good practices are observed.

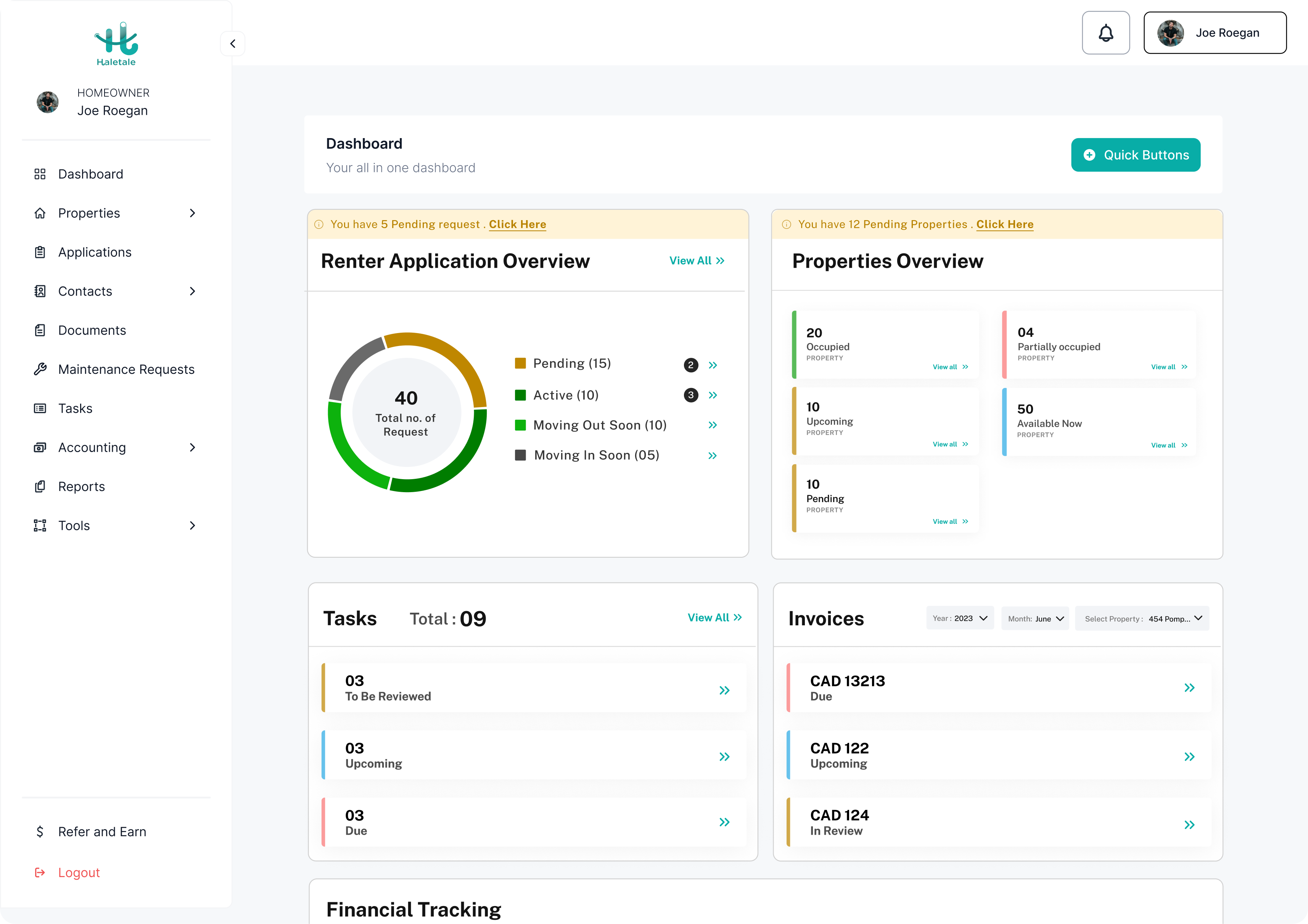

Find the best Rental Property Management Software in Canada. Transform your Rental property into a cash-generating asset with our user-friendly property management software solution.

Smarter Property Management

Call to Action

Landlords are recommended to explore the possibility of incorporating rent reporting among providers as one of the ways to support their tenants’ financial well-being and to improve their own rental business. Through making rents on time reporting to the credit bureaus, landlords create a variety of benefits not only for themselves but also for tenants too. In case you would like to have additional information on the process, possible difficulties and appropriate law aspects of report the rent, feel free to contact our company personnel anytime. Be assured that we will help you along the way to make this an advantageous occasion and to have a successful implementation that is mutually beneficial to all the concerned parties.