Both advantages and disadvantages come with sharing a home or living with roommates. This is particularly true when it comes to budgeting and bill splitting. Tenants face difficulties when it comes to equitably splitting costs in co-living settings. Managing division of rent and utility bills needs efficient communication and well-organized procedures. We’ll go over the usual difficulties in dividing bills amongst roommates here. Furthermore, we will offer doable fixes and tactics to hurry the procedure. This include promoting openness and equity in handling shared costs in co-living situations. Read our blog about how to split bills fairly in a co-living situation.

What is bill-splitting?

Bill splitting refers to the practice of dividing common expenses like rent, utilities, groceries, and other household bills. It entails figuring out who pays what proportion of the costs. It also involves handling the money side of shared living arrangements well.

Maintaining harmony and equity among co-livers is the reason that bill splitting is important in co-living. In the home, openness, trust, and accountability are fostered by a reasonable and open sharing of costs. It lessens miscommunications, arguments, or animosity between roommates. These situations may arise from differences in income or disproportionate contributions to shared expenses. Co-livers may ensure that everyone pays their fair amount. This helps to foster a cooperative and peaceful living environment. It also means applying an organized method to bill splitting. Additionally, a well-organized system for handling spending makes the home run more smoothly. This frees up roommates to enjoy their living situation instead of worrying about money. Overall, to foster a positive and friendly atmosphere, proper bill-splitting practices are essential.

What are Some Ways You and Everyone Can Split Your Bills?

1. Equal Division:

This simple strategy divides all costs equally across roommates. It does not take into account consumption or income. It makes cost-sharing simple and equitable. This is ensured by requiring each participant to contribute an equal amount towards rent, utilities, and other household expenses. Simple as it may be, this approach may not account for different income levels or personal consumption habits.

2. Income-Based Division:

A fairer strategy takes into account each person’s economic level. Roommates split the cost of living according to their incomes. This strategy seeks to prevent those with lower incomes from having an unfairly heavy financial burden.

3. Usage-Based Division:

Grocery and utility costs are shared according to one’s consumption. Utility bills, for example, can be divided based on how much gas, electricity, or water is used by each individual. Since users only pay for what they use, this approach maintains fairness, even though it may take more work to track usage.

4. Hybrid or Customized Approach:

Combining methods based on specific expenses can offer a more balanced approach. For example:

– Equal division for fixed costs like rent.

– Income-based division for variable expenses, where individuals contribute based on earnings.

– Usage-based division for utilities or shared services.

5. Rotating Responsibilities:

One way to guarantee that roommates contribute fairly is to have them switch off who pays which bills each month or every quarter. For example, one person oversees the electricity this month, and another person handles the groceries the next. This approach prevents one person from continually enduring the same costs. It also encourages shared responsibility.

6. Shared Expenses Agreement:

Make an in-depth and clear agreement detailing the distribution of expenses. Add details like which bills are split, how the bills are split, when they are due, and what happens if you pay after the deadline. To guarantee openness and understanding, the terms should be discussed and decided upon together.

7. Budgeting Tools and Apps:

Make use of apps for tracking spending, managing joint budgets, and splitting spending while creating a budget. Determining each person’s portion, it simplifies money administration in a co-living setting. It can also speed up the process.

8. Regular Communication:

Remain upfront with your roommates about any shared expenses. Call regular meetings to go over the budget. Address any issues and if needed, reevaluate the selected bill-splitting strategy. This guarantees openness and permits modifications in response to evolving situations.

9. Flexibility and Compromise:

Stay adaptable and willing to make concessions. For certain costs or circumstances, various approaches might be more effective. Fairness and harmony in the living area are ensured by being flexible and open to change course.

The relationships between roommates, financial situations, and personal tastes all play a role in selecting the best approach. It is crucial to choose a plan that takes into account the requirements of all parties involved. The method also needs to maintain justice. It will help to cultivate a respectful and cooperative home environment. Regular evaluation of the selected approach guarantees ongoing equity and flexibility.

Frequently Asked Questions

● How should roommates split bills in a co-living situation to ensure fairness?

Loads of methods can ensure fairness in bill splitting:

– Equal division treats everyone equally.

– Income-based division considers earnings.

– Usage-based division allocates costs based on individual consumption.

Choosing the most suitable method requires consensus among roommates to ensure fairness.

● What are the common expenses in co-living situations that need to be split?

Commonly shared expenses include:

– Rent

– Utilities (electricity, water, gas)

– Internet and cable

– Groceries and household supplies

– Cleaning services (if hired)

– Maintenance and repairs

These expenses often need to be divided fairly among co-livers.

● How can co-living residents track shared expenses and payments efficiently?

The process can be improved by using apps made especially for sharing expenditures. Splitwise, Venmo, and Google Sheets are apps that make it easier to split, track, and pay for shared spending. With the help of these apps, housemates may split bills, keep track of spending, and communicate when payments are due.

● What disputes can arise from splitting bills, and how can they be resolved?

Conflicts may emerge about uneven contributions, or; late payments. There might be different opinions about the selected approach. Solving this include:

– Open communication: Discuss concerns openly and regularly.

– Compromise: Be flexible and willing to adjust.

– Clear agreements: Draft a shared expenses agreement. This should outline the chosen method and responsibilities. Include the consequences of late payments.

– Mediation: Consider involving a neutral mediator if disputes persist. This will ensure a fair resolution through discussion and compromise.

Implement clear communication and a structured approach to bill splitting. A willingness to find common ground can prevent and resolve most disputes among roommates.

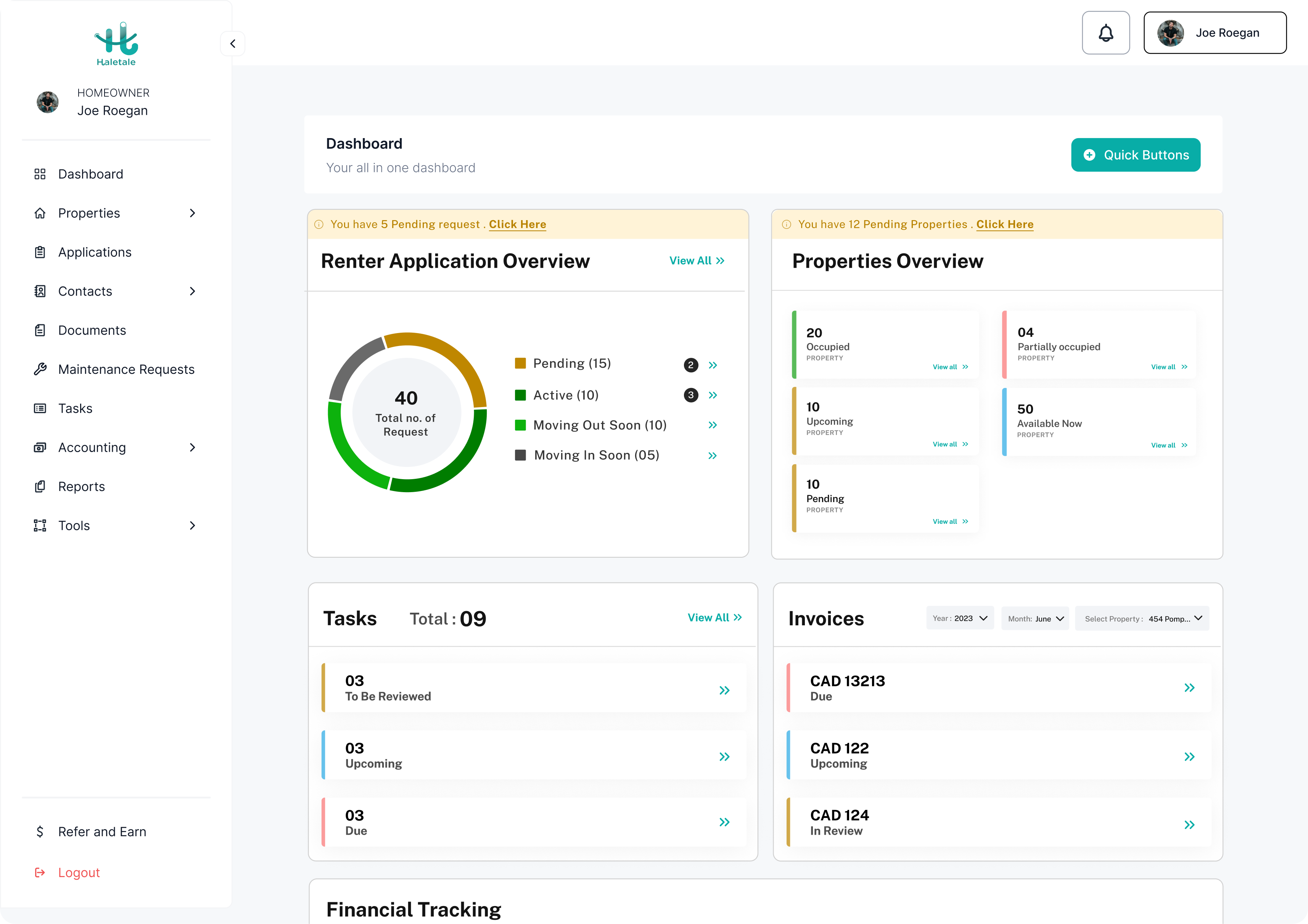

Smarter Property Management

Find the best Rental Property Management Software in Canada. Transform your Rental property into a cash-generating asset with our user-friendly property management software solution.

Conclusion

Reasonable ways such as usage-based and income-based are needed for proper bill splitting in co-living. Roommates must be open, honest, and truthful with one another to ensure fairness. Ensure smoother financial management by using technology to monitor expenses. Promoting regular communication, and drafting agreements can also lead to better financial management. The value of transparency and communication cannot be stressed enough. These are the foundations of happy cohabitation. It will prevent problems and foster a cooperative environment. In such a situation, everyone can feel involved and appreciated. Use these bill-splitting techniques to establish an equitable and open financial structure in your co-living area.