Yearly Maintenance Checklist for Landlords

One of the most crucial responsibilities of a landlord is performing maintenance on their properties. If not carefully managed, a …

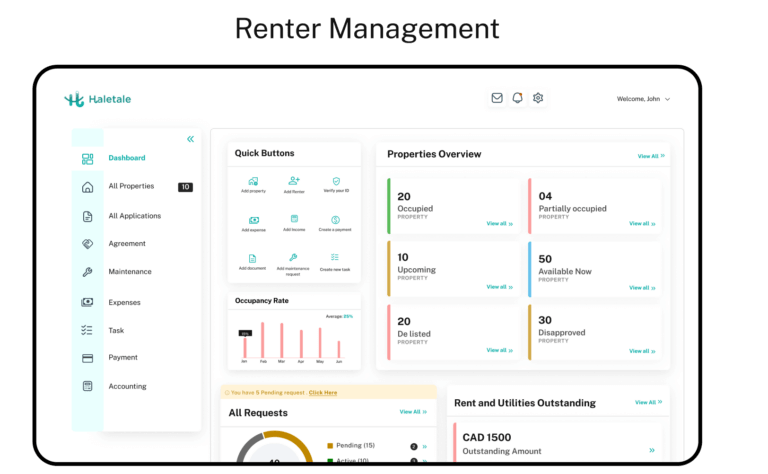

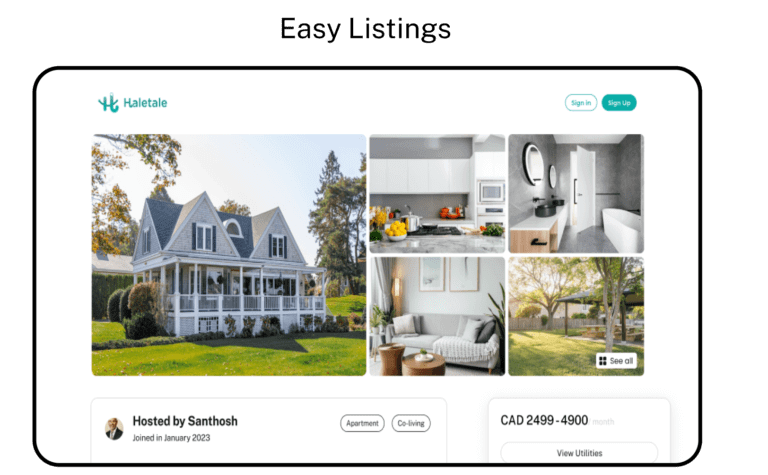

Find the best Rental Property Management Software in Canada. Transform your property into a cash-generating asset with our easy-to-use platform. Automate tedious tasks and unlock the power of co-living to maximize profits!

Join our thriving community of 500+ property owners and managers who are reclaiming valuable hours in their day through effortless house hacking and automating their essential day-to-day property management tasks through Haletale.

Higher Revenue

Time Saved

On-time rent payments

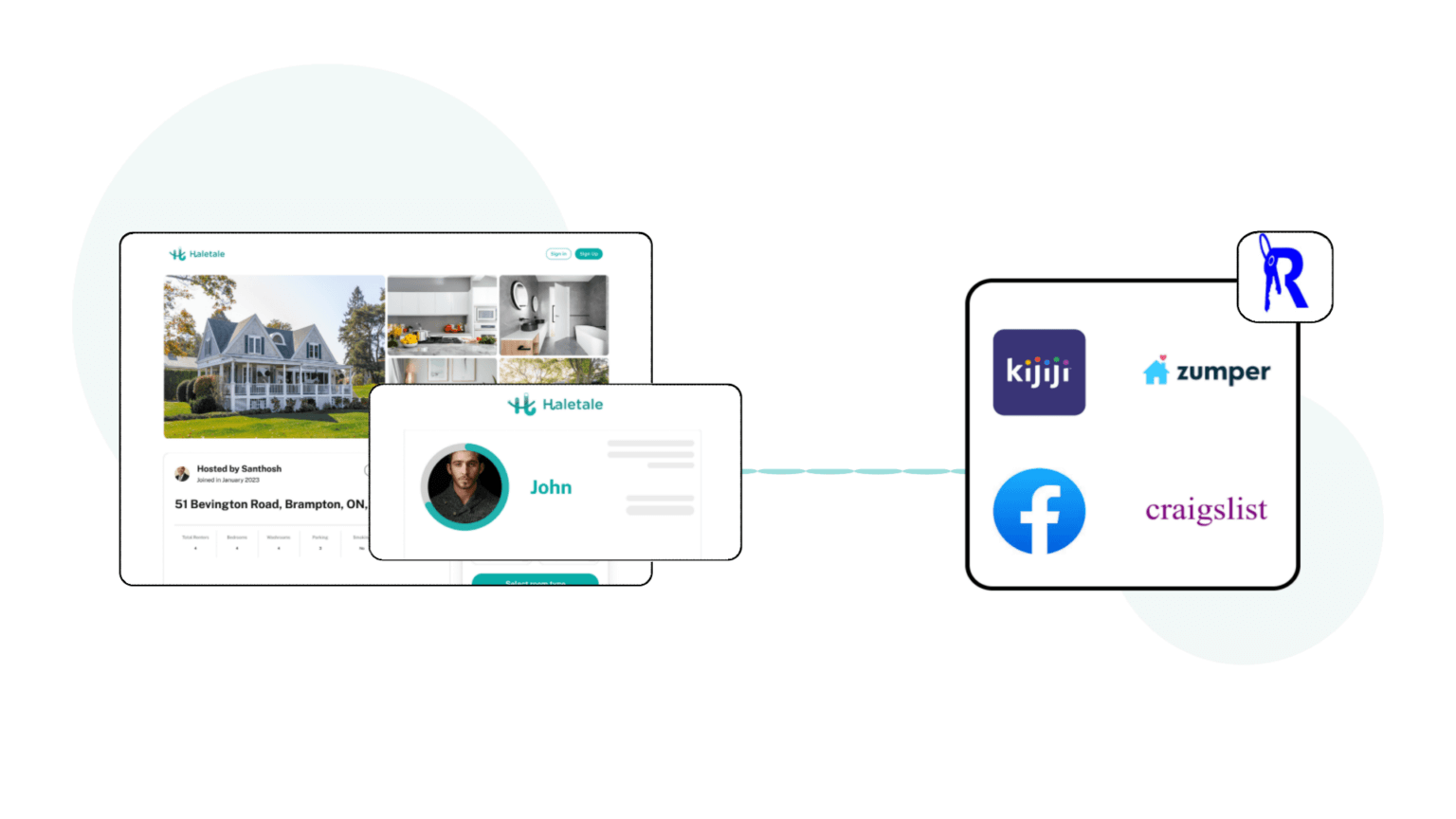

Advertise your property on major marketplaces and attract the perfect set of renters for your rental space

Advertise on almost every marketplace like Zumper

Create Appointment Scheduler for planned visits

Automated communication to the renter

Review renter applications and make informed decisions

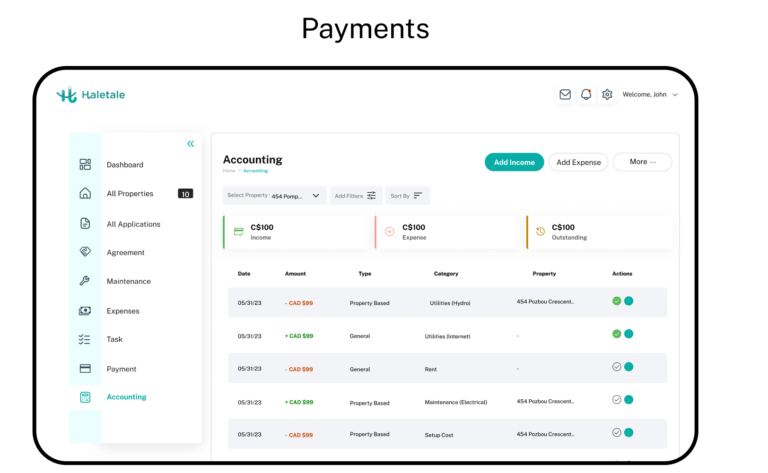

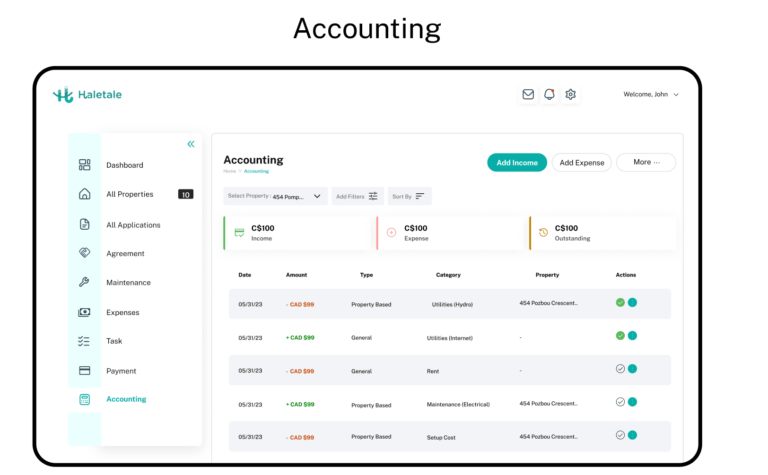

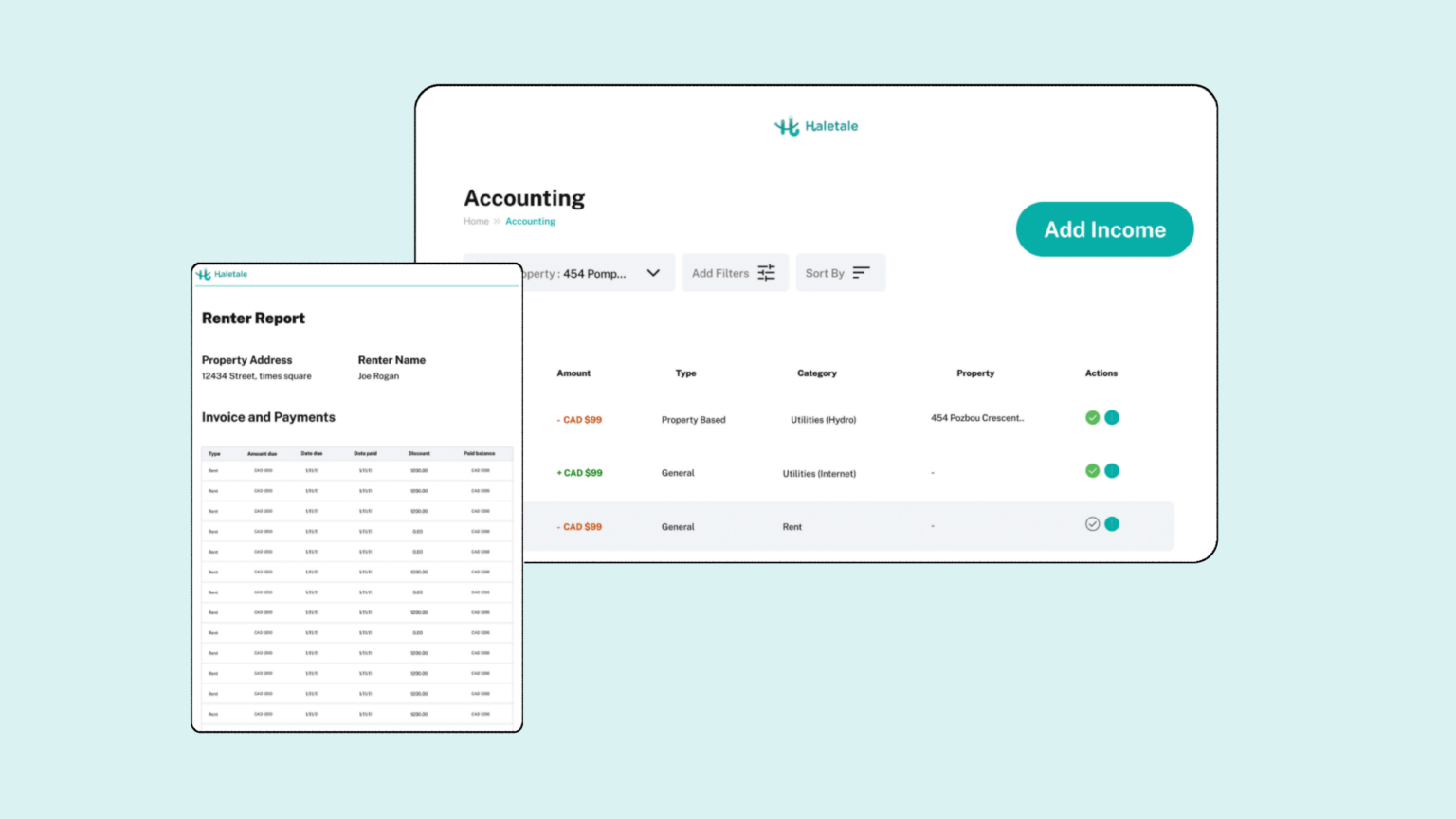

Gain control over your property finances with smart and simple accounting features and payment processes

Collect and track your payments

Schedule automated reminders to renters

Perform in-app accounting

Get one-click financial reports for your property

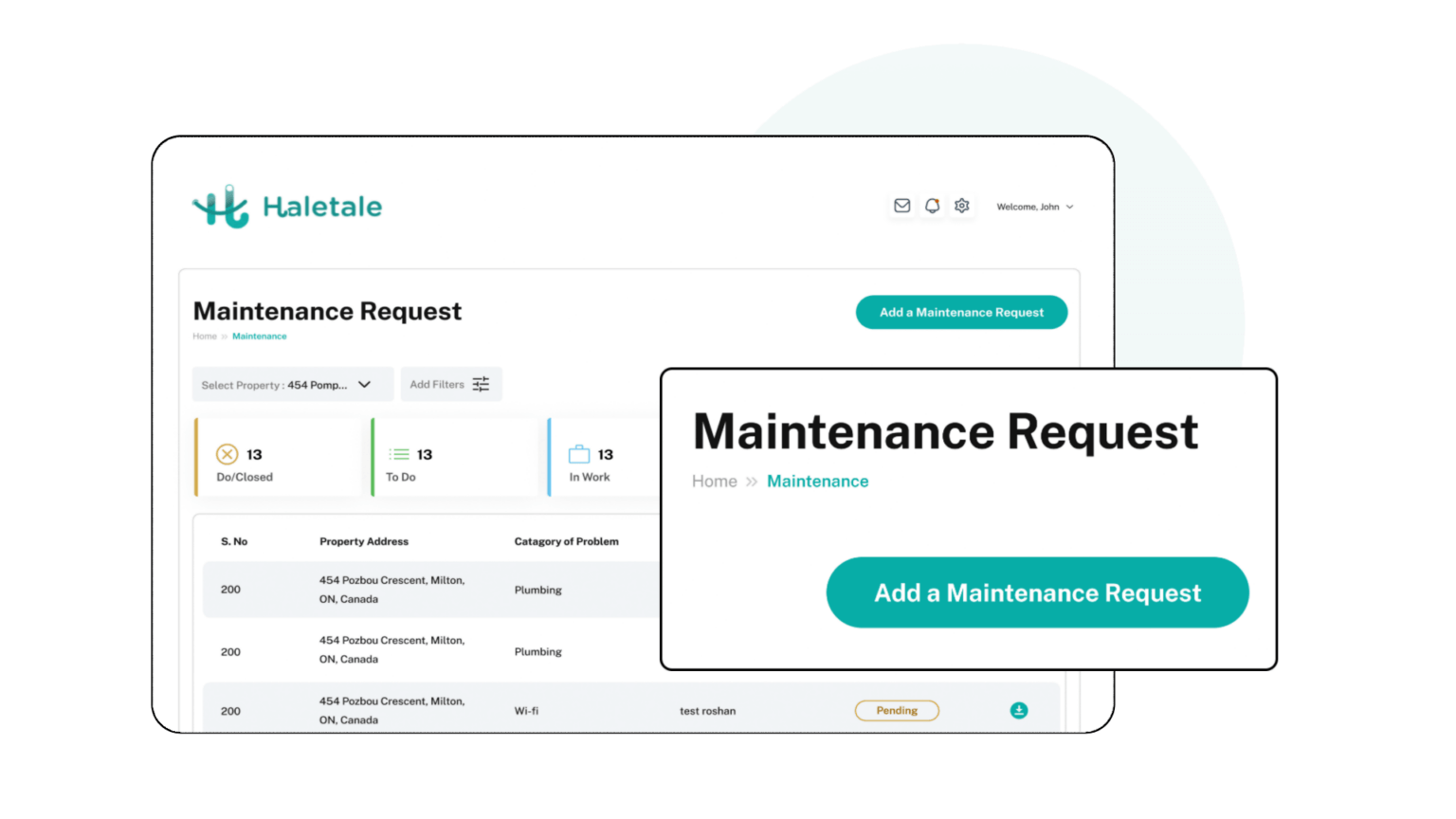

Review and schedule maintenance requests

Send real-time messages

Schedule in-house tasks, inspections, etc

Automated notifications to renters for every task

Submit a ticket to our 1on1 Support Desk for any problems or questions you’ve got.

Read the documentation and learn how to make the most of the platform

Watch our video tutorials, step by step instructions to navigate.

Discover frequently asked questions, we have all the answers ready for you!

One of the most crucial responsibilities of a landlord is performing maintenance on their properties. If not carefully managed, a …

The Canadian Property management sector has experienced a tremendous amount of change, driven primarily by technological advancements and sustainability concerns …

Workspace management, according to OfficeRnd is the overall strategy businesses use to manage various elements within a work environment, including …

Sustaining success in the highly competitive property management industry requires maintaining high tenant retention rates. While finding new tenants is …

In the constantly evolving field of property management, attracting new tenants is an ongoing challenge that is essential to sustaining …

Success in the field of property management mostly depends on efficiency and structure. Spreadsheets were the primary tool used by …

1

1

We are improving Haletale on the go. Sign up below to stay up to date on our full website launch.