ROI has become an important determinant in financial planning and decision-making. It constitutes a golden rule for assessment of investment performance. An investor and a business entity can use it as a tool to make rational financial decisions. ROI calculators are turning out to be essential tools in this process, allowing one to compute the profitabilities of different financial undertakings with precision.

The financial calculation accounts for factors like initial investment, expected returns and the time length of the investment, so they give comprehensive analytics, helping people to understand whether the financial decision is feasible or not. Through the analysis of the Return on Investment of a certain investment, one can tactfully decide, efficiently optimize their financial resources and ultimately accomplish their desired goals in the long run.

Understanding ROI and Its Importance

ROI (Return on Investment) is an important measuring tool that identifies an investment’s profitability and efficiency. It sets a definite numerical indicator for the income or loss achieved from an investment and the outlay made.

The basic ROI calculation is simple: ROI = (Net Profit / Investment Cost) x 100. It is the formula that helps investors to evaluate the possible returns of various investment options and decide intelligently about how to distribute their resources.

ROI has a critical function in business strategy and financial plan formulation. This will give the companies the necessary ROI of investments that include new marketing campaigns, technology upgrades, or business expansions to enable them to focus on the most profitable undertakings. This enables companies to create the most profitable and efficient enterprise.

Incorporating ROI into personal financial planning is also a vital part of the overall process that individuals follow when they want to reach their long-term financial goals. Investors determine the potential rate of returns from various investment options such as stocks, real estate, or retirement accounts, and make a choice that best suits their level of tolerance of risk and returns required.

Additionally, ROI should come as a secondary factor for decision-making, whereas other pertinent factors like risk, liquidity, and consistency with the overall financial strategy must be taken note of. Consequently, recognizing and using ROI is essential for both businesses and individuals to be equipped with the data in order to make decisions that will optimize their financial resources and give them the chance of succeeding in the long term.

How ROI Calculators Work

ROI calculators enable users to easily and exactly evaluate the return on an investment or a project. These calculators are usually endowed with features whereby the user has to put in a few basic variables such as the initial amount of investment, anticipated returns or benefits and the time period over which the investment will be assessed.

With these inputs, the ROI calculator can then compute the return on investment using the formula: ROI = (Net Profit / Cost of Investment) x 100 where the net profit is the amount earned minus the initial investment, and the cost of investment is the initial investment.

Benefits Of Using ROI calculators

- Improved accuracy: ROI calculators not only can do complex calculations but they also may take into account a number of factors, such as the time value of money, that can reduce profitability of an investment. This assists in achieving accurate and trustworthy ROI analysis.

- Faster analysis: Instead of having to manually compute ROI, these tools will do the work instantly and present the results for an investor to compare and evaluate multiple options.

- Informed decision-making: These calculations that allow users to decide confidently where to allocate resources based on the clear, quantifiable measure of investment potential returns is enabled by ROI calculators.

- Improved communication: ROI calculators are visual tools that can be employed to develop attractive reports and presentations that efficiently show the benefits of an investment to the decision makers, including CEOs and investors alike.

- Ongoing optimization: Some ROI calculators enable users to tweak input variables and see how manipulations of those variables like expenses and expected returns will affect the overall outcome of the investment. This can empower users to stay on top of their financial planning.

Applications of ROI Calculators in Different Sectors

In the real estate sphere, ROI calculators are instrumental in assessing the potential financial viability of an investment property deal. The inclusion of variables like the purchase price, rental income, operation expenditure, and mortgage cost helps calculators give a good idea of the anticipated gains from real estate investments. Thereby, they can compare different real estates and find out the best deal.

For stock market investors, ROI calculators can help determine whether investments yielded profits or losses using different strategies. These tools can include things such as beginning investment, stock prices, dividends, and length of holding to derive the net ROI. They do this by providing more concrete information which enables investors to make wiser decisions about which stocks or assets to include in their investment portfolios.

ROI calculators in project management are the tools of choice for assessing feasibility of proposed allocations of resources and for obtaining approval for fresh initiatives. Through the determination of the expected returns on investment in technology upgrading, process improvement and marketing implementations, project managers will be able to confirm the financial viability of their proposal and acquire the required approval from stakeholders.

ROI calculators for businesses are indispensable for assessing the monetary feasibility of multiple ventures and programmes. They can be used to measure the expected revenues from a new product launch, entering new markets, or investing in employee growth and development. It can be really important for companies to know the ROI of these initiatives so that they can make more informed decisions on where to spend their resources to have maximum impact.

Thus, ROI calculators have become essential tools to be used by various companies in different sectors, and they allow people to arrive at data driven decisions that optimize their financial resources and so make them more successful in the long run.

Improving Investment Strategies with ROI Insights

An ROI calculator allows for portfolio diversification and optimization. ROI calculations of different investment options like stocks, bonds, real estate, and alternative assets will enable the investor to ascertain which asset performs better relative to the others, and then investors can make informed decisions on the portfolios. By doing so, they can spread risks and returns between different assets of their portfolio, which in the end maximizes their profitability.

For example, an investor who wants to evaluate their portfolio’s performance against a relative index can use ROI calculator tools. ROIs of certain stocks if ceaselessly underperforming, the investor can then make the intelligent decision to reallocate the funds to higher-performing assets, thus increasing the ROI of the portfolio.

However, ROI calculators can also help in the area of risk control management. Through grasping the distinctive rewards and involved risks of different investment choices, an investor or manager is able to take into consideration which risks should be accepted, and which not. This aids them to make a robust investment strategy which is flexible enough to maneuver through market shocks and any uncertainty in the economy.

How to best make use of ROI calculators:

- Clearly define investment objectives and risk tolerance: Make sure to develop a clear financial goal and assess your risk tolerance before considering any investment alternatives.

- Regularly review and update ROI calculations: Keep monitoring of your investments’ performance and adjusting your strategy according to new market conditions and opportunities as they appear.

- Diversify your portfolio: Spread your investments among different asset classes in order to counter risk and achieve more total returns.

Through utilizing these strategies and ROI calculators, investors and business managers can sharpen their investment strategies, enhance their portfolio thus making their returns better even as they manage the risk more efficiently.

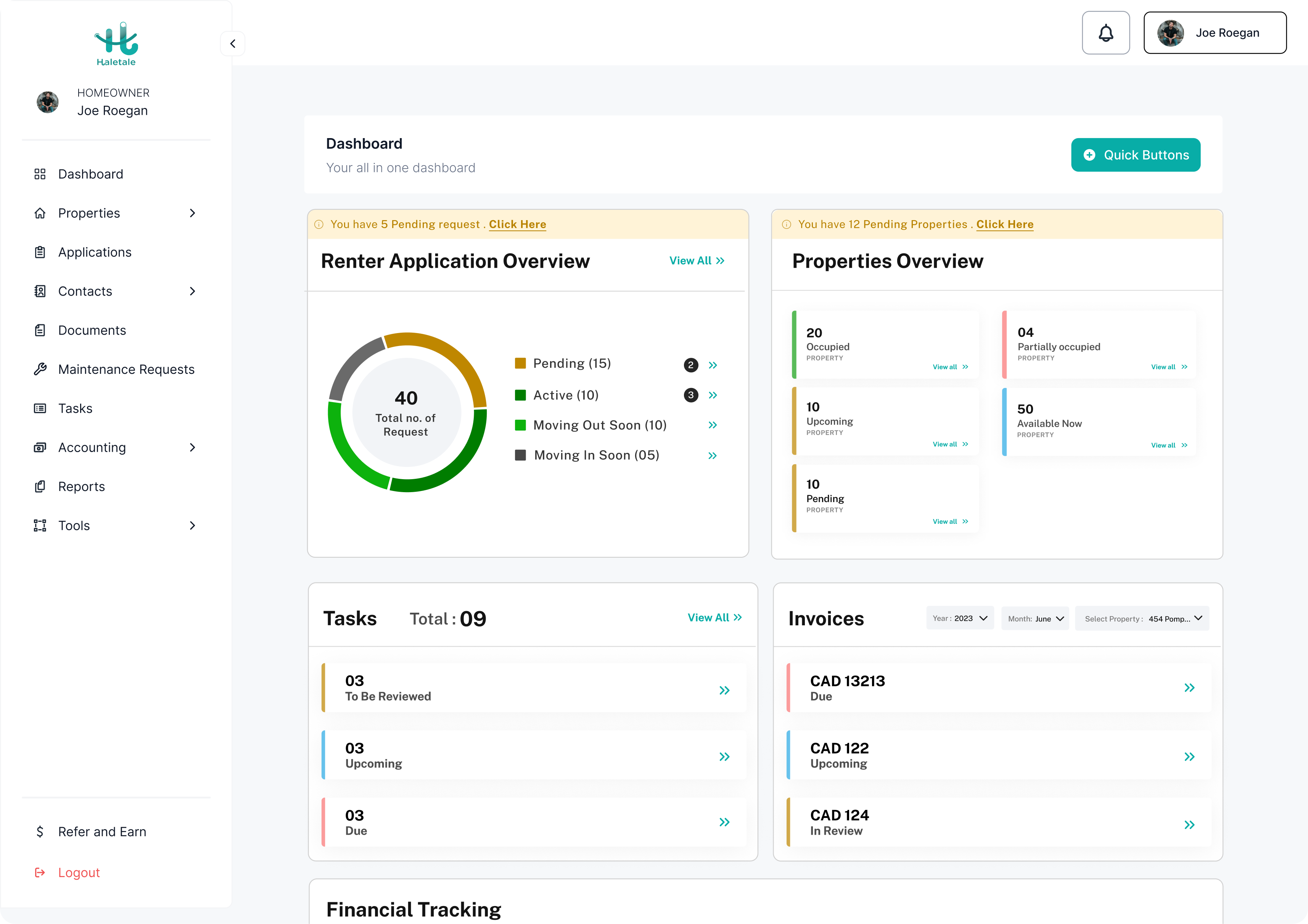

Smarter Property Management

Find the best Rental Property Management Software in Canada. Transform your Rental property into a cash-generating asset with our user-friendly property management software solution.

FAQs:

-

What is an ROI calculator, and how does it work?

ROI calculator tools allow the user to perform a cost-benefit analysis of an investment/project within a short period in an accurate manner.

ROI calculators, as a rule, require users to pass on the variables like primary investment, benefits/gains, and duration.

The calculator then computes the ROI using the formula: ROI = (Net profit / Cost of Investment) x 100.

-

Why is ROI an important metric for investors and businesses?

ROI is a qualitative measure of the results or losses that come from the investment, and it is compared with the cost of the investment.

This plays a pivotal role in business strategy as well as financial planning as it can help the organization in determining which course of action is likely to give the highest returns.

Concerning individuals, the ROI perspective is very important for placing strategic decisions to align financial targets and their risk tolerance.

-

How can ROI calculators enhance decision-making in investment and project management?

ROI Calculators can make analysis more precise by allowing for various factors that affect profitability to be accounted for.

They allow for quicker review and comparison of many investment choices thus, enabling individuals to make smarter and data based choices.

High-fidelity ROI calculators can be used to create visually appealing reports and presentations that can be used to convincingly communicate the benefits of an investment to different stakeholders.

A few ROI calculators allow the users to modify the input variables and see what adjustments could result in higher profitability and optimized use.

-

What are some common mistakes to avoid when calculating ROI?

Conflating cash flow with gains like comparing initial investment (cash) with profit or revenue is not a correct way of reading financial figures.

Initial costs may be underestimated as a result of failure to include in the calculation all the relevant expenses.

Not factoring in the human factor, time, and labor as part of business investment

Analyzing incorrect metrics that do not indicate the main goals of the business with priority

Measurement of too many areas instead of focusing on essential key performance indicators (KPI)s.

Conclusion

ROI, in short, is a distinct measurement that gives an investor a clear and measurable index to assess the profitability of their investment. Today, ROI calculators are irreplaceable resources for managers as they enable investors to assess potential returns of different options precisely and analyze them in more detail, making for data-driven decisions.

Call to Action

We urge you to test these ROI calculators and employ them while analyzing the opportunities in investment and making the corresponding decisions. Be an active participant by sharing your experiences and tips in the comment section or social media sites, and be part of the group of informed business owners and investors that look into practical ways to boost the profitability and the efficiency in of their financial decisions.